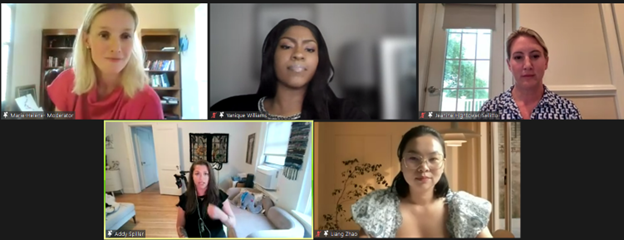

The interns were introduced to an innovative topic in Session 6 on July 25, 2023, which was new to the WSE program: The Future of Finance: Career Paths in Digital Assets and FinTech. A poll indicated that some of the interns had a general knowledge of fintech and digital assets but most did not. The novel session was moderated by Marie Helene Kennedy Payen, FWA member and Senior Director, Operations and Community, New York Life Ventures. She was joined by panelists Yanique Williams, Senior Privacy Program Manager, Fintech, at Meta; Jeanine Hightower-Sellitto, Chief Commercial and Strategy Officer, EDX Markets; Addy Spiller, Senior Director of Product, ORKA Finance; and Liang Zhao, Chief Executive Officer, Vansary.

The session kicked off with a description of digital assets and fintech and how both bridge technology with finance, bringing innovation in a traditional space, and giving more power to people. Both represent a disruption where people are bridging what they have learned and are applying technology to create the future. As one panelist explained, digital assets have value that can be digitized and are identifiable on the blockchain. The value has been created or produced on a chain like bitcoin and can be an NFT like art or a collectible. As a result money coaches and financial coaches like Jim Cramer have emerged and social media is being leveraged to help their viewers learn more about finance. Services are blossoming in print and media that provide resources that people can benefit from. Examples are Mrs. Dow Jones, Vivian, your Wall Street Girlie, and articles being written for online publications like Medium.

The panelists highlighted the key characteristics that are important in these areas which include being innovative, having a positive mindset and a “can do” attitude which makes other people feel better about working with you, and being easy to work with. The ability to effectively communicate is also important as well as managing upwards. The explanation of what it means to manage up was explicit – a manager should not have to guess the status of your work; over-communicate by providing a regular summary; advocate for yourself; and be succinct with bullet points and not a wordy, long document. If interested in this career path, the panelist recommended taking a business writing course.

The interns posed questions regarding starting your own business. A panelist outlined key questions to ask before you take the plunge: 1) What’s the problem you’re solving? 2) How is your business the solution 3) What’s the total available market for the business? and 4) What is your business operating model?

The interns left with the following advice from the team:

- Build your own network

- Do something that scares you

- Trust your process

- Prioritize self-discovery

The WSE Co-Chairs extend our sincere thanks and appreciation to Marie Helene, Yanique, Jeanine, Addy, and Liang for your unwavering support and generosity to the interns and the Wall Street Exchange Program. We appreciate you sharing this innovative and progressive topic with them, and for your many words of wisdom.